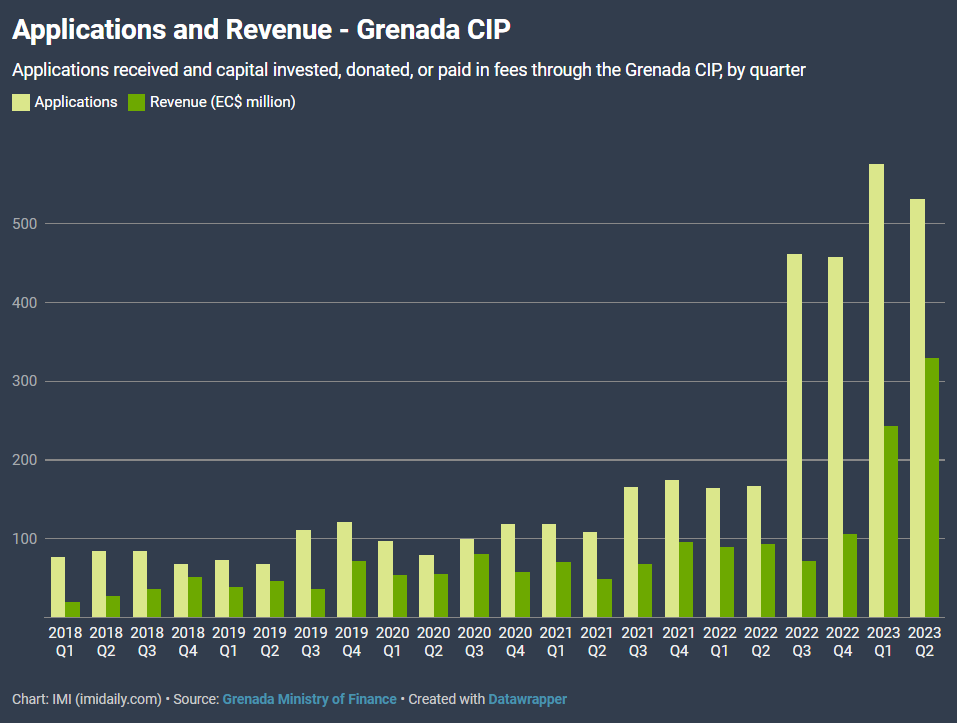

The frenzied levels of demand for Grenadian citizenship by investment – which began in the spring of last year as Grenada’s CIP became the Caribbean’s only such program to accept Russians – continued its unrelenting ascent in the second quarter of this year, according to figures released today.

The quarterly report from Grenada’s Ministry of Finance shows the CIP continues to shatter all its own previous records:

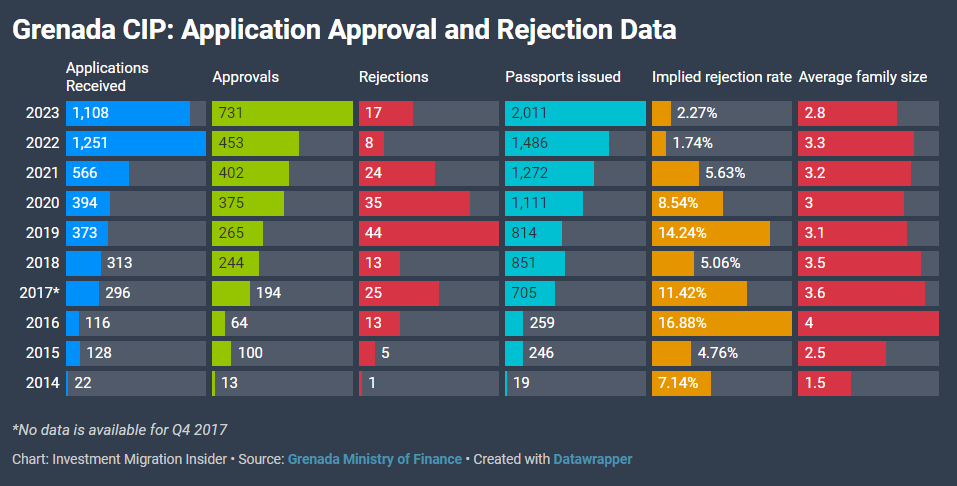

- Record six-monthly application volume: 1,108 (up 235% year-on-year)

- Record six-monthly processing volume: 748 (up 203%)

- Record six-monthly passports issued: 2,011 (up 160%)

- Record six-monthly program revenue: EC$573 million (up 213%)

In other words, application volume, processing volume, and program revenue have all more than tripled since the same six-month period last year.

As if that were not enough, Grenada has already beaten some annual records, even with half of 2023 to spare:

- Record annual approvals: 731 (already up 61%, with six months to go)

- Record annual passports issued: 2,011 (already up 35%, with six months to go)

- Record annual program revenue: EC$573 million (already up 60%, with six months to go)

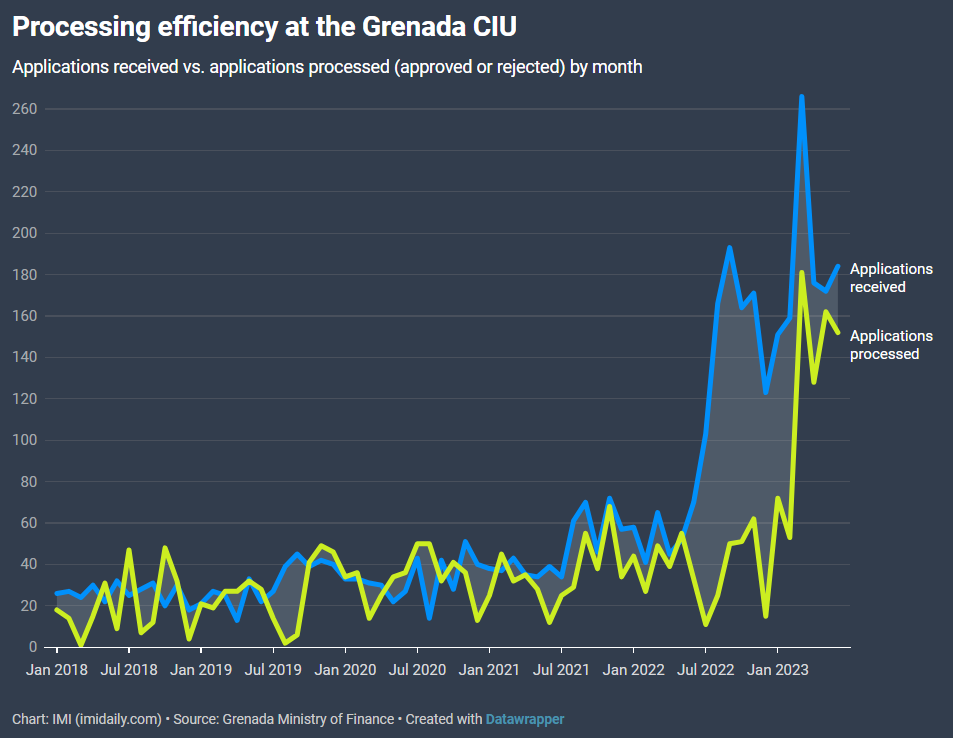

Unlike what’s been observed in the golden visa programs of Portugal and Greece, Grenada’s program authorities have done a decent job of keeping up with suddenly and sharply rising application volumes. These valiant efforts notwithstanding, Grenada still had at least 1,541 files pending a decision as of July 1st, a backlog that has grown by 90 applications since Q1.

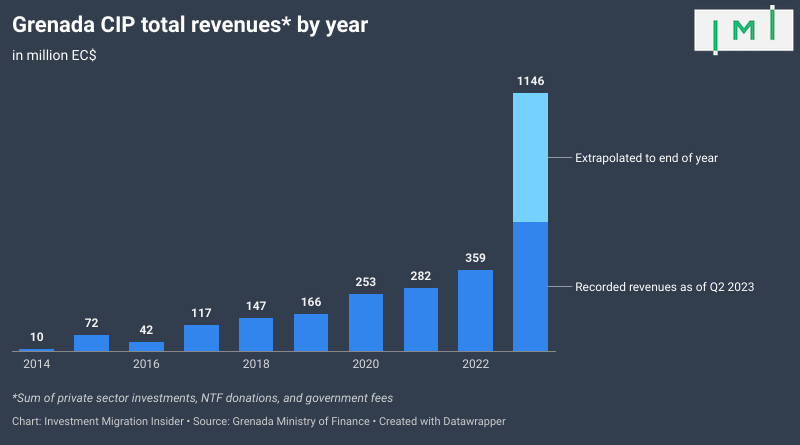

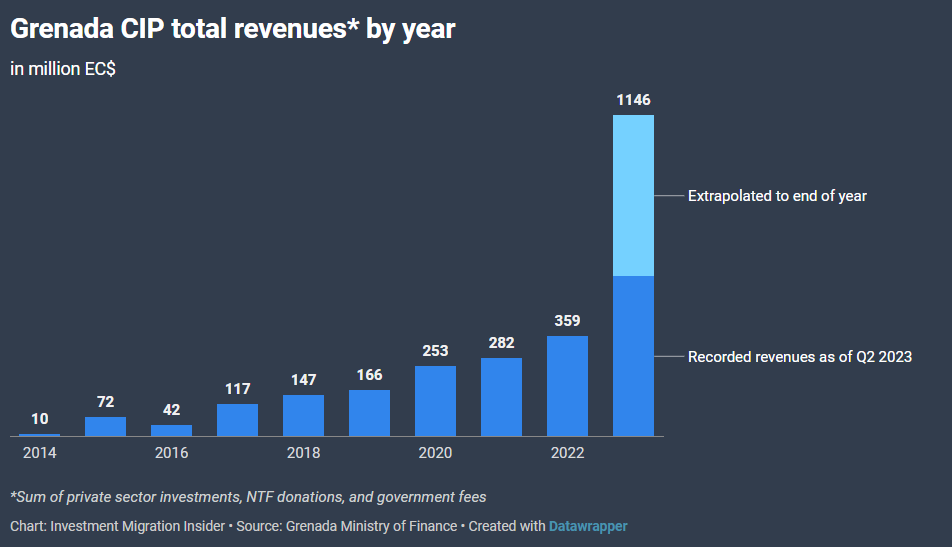

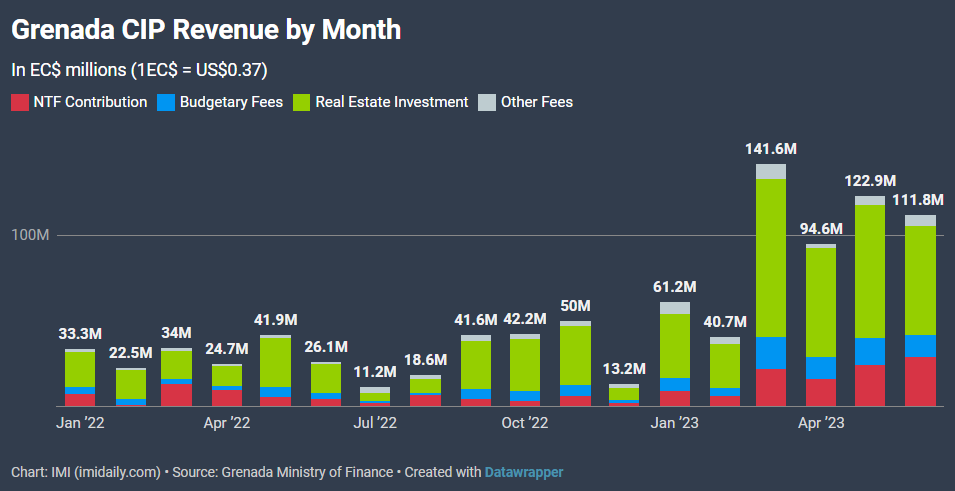

The meteoric rise in application volumes has naturally pushed program revenue up as well. In Q2 2023, while application volume fell slightly, total program revenue (including donations, investments, and government fees) reached EC$329 million, another all-time high.

Of the total EC$329 million, some EC$205 million found its way to real estate developers, about EC$70 million to the National Transformation Fund, and the remainder to government coffers.

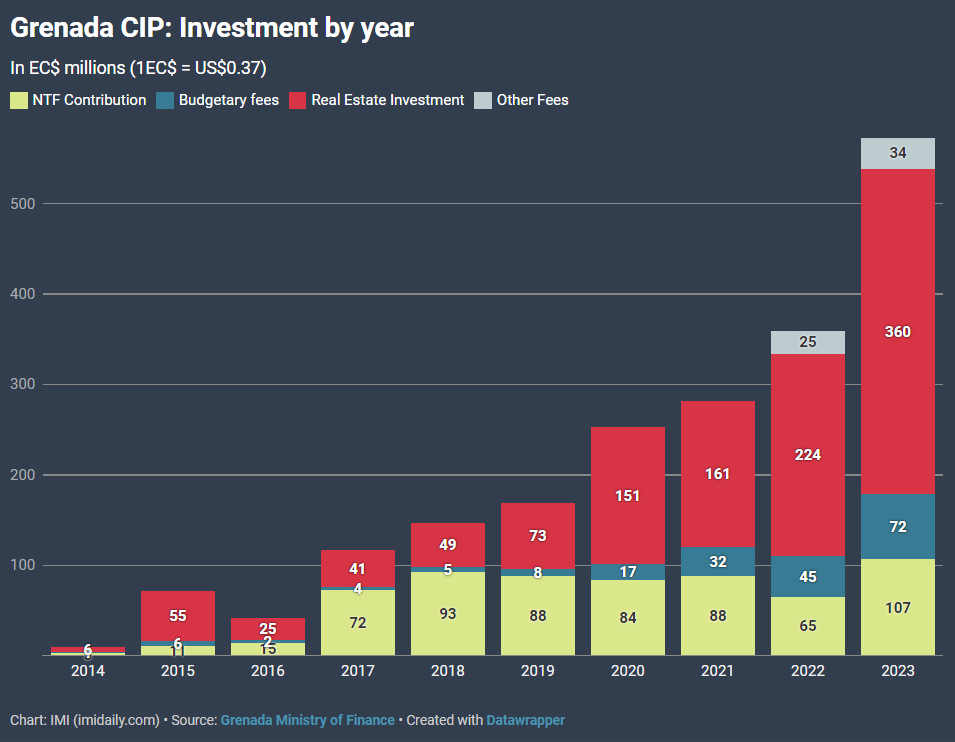

In just the first six months of this year, Grenada’s CBI developers raised EC$360 million (US$133 million), nearly as much as in the preceding two years combined.

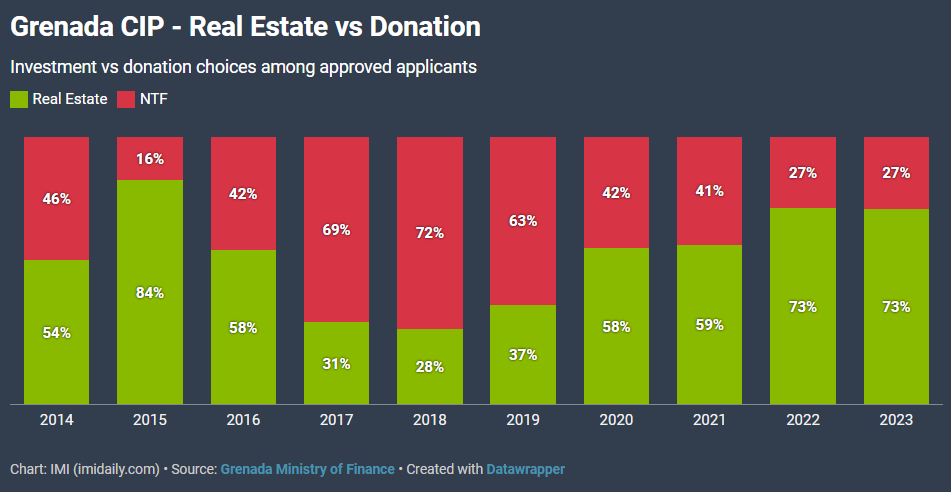

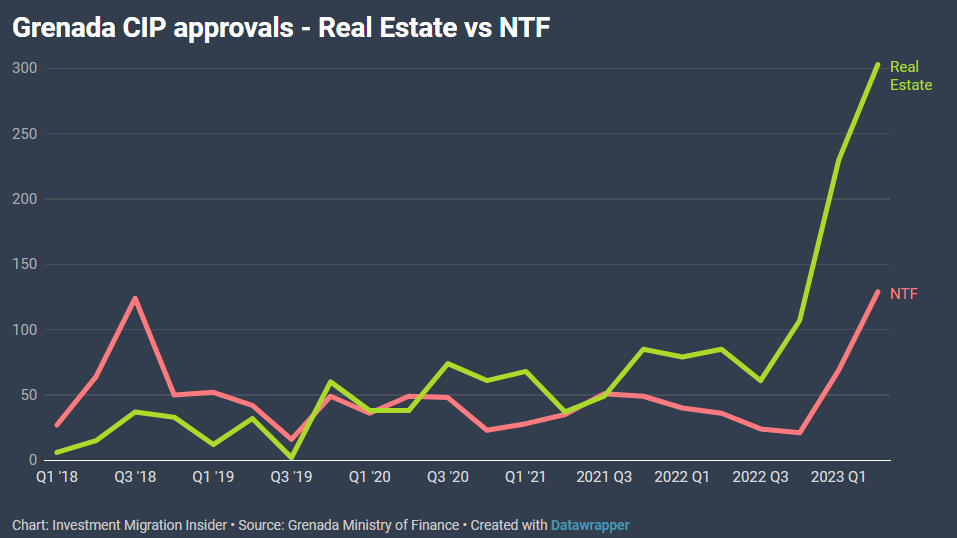

So far in 2023, three-quarters of Grenada CBI applicants have chosen to invest in real estate.

Less than two years ago, the NTF and real estate investment options were roughly on par regarding approval volume. Since then, a wide gap has opened up between the two options as investors increasingly favor property.

What’s in the cards for Grenada’s CIP in Q3?

As part of its multilateral agreement on the “6 CBI principles”, Grenada is now committed to excluding Russians (and Belarusians) from the program. This will no doubt have a dampening effect on application volume.

On the other hand, Saint Kitts & Nevis’ CIP recently made the unilateral decision to double its minimum investment amount requirements, which means Grenada – for the time being – has one less competitor to worry about.

Among the remaining three programs, only Dominica’s CIP is a serious contender in the CBI real estate market; Saint Kitts & Nevis has twice the price, Antigua & Barbuda’s real estate option has been near-dormant for years, and Saint Lucia has but two approved developments, both of which have demonstrated only limited construction progress since they were first approved years ago.